In fact, The Lipstick Effect, a term coined by Leonard Lauder in 2001 to describe the influx of makeup sales during the recession, is still used today as a barometer of consumer confidence during periods of economic turmoil. This phenomena suggests that people will continue to buy cosmetics in most categories despite economic shifts. You can read more about The Lipstick Effect here.

This effect continues to reign true as we enter the final quarter of the year. Prestige Beauty has been enduring the economic decline through 2023, maintaining its position as the only industry to grow based on units sold across the general merchandise and consumer packaged goods categories.

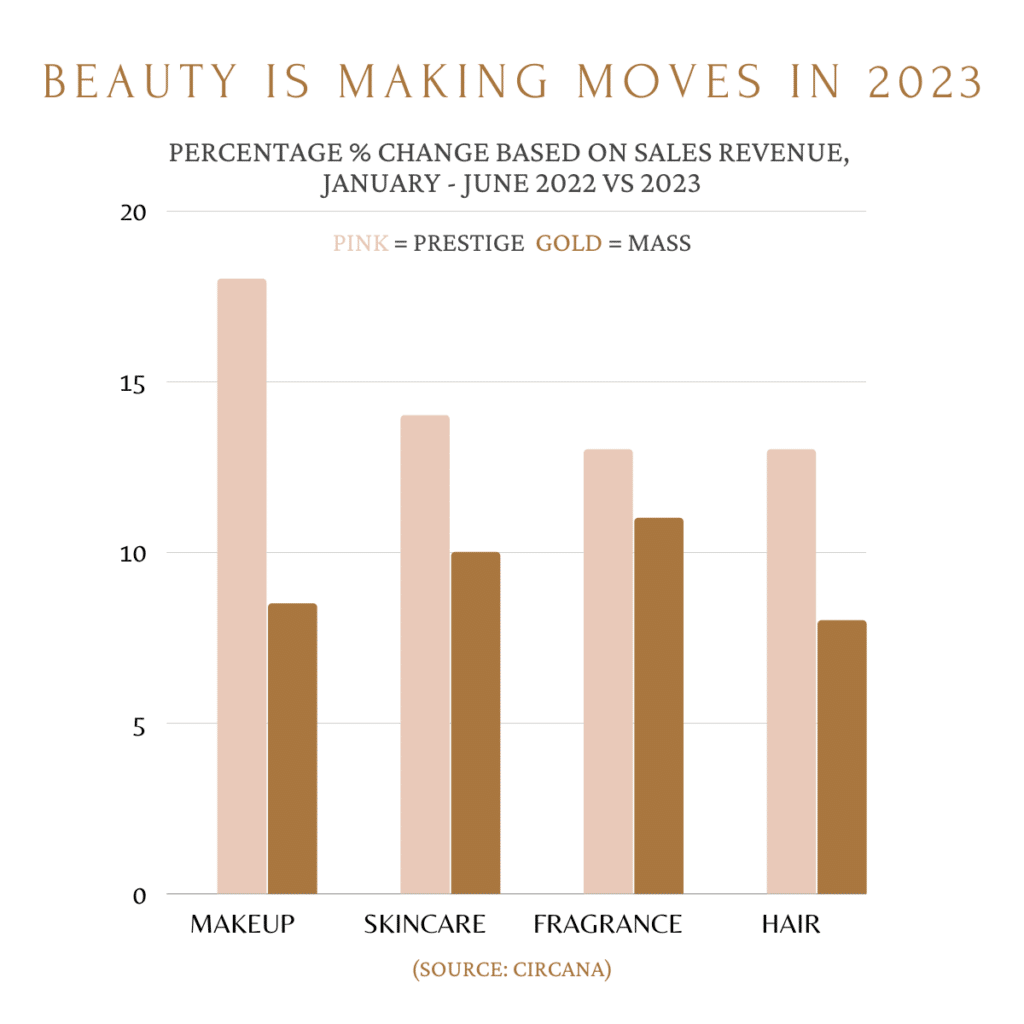

According to Circana (formerly IRI and The NPD Group), “U.S. prestige beauty industry sales amounted to $14 billion in the first half of 2023, a 15% increase versus the same period in 2022. In comparison, the mass beauty market generated $28 billion and grew 9%.”

Here’s what’s trending!

Makeup has been the fastest growing category within the prestige market, with sales revenue up 18%. Lipstick was the fastest-growing segment across all the beauty categories and inclusive of both prestige outlets and mass merchants.

Makeup usage is also on the rise in comparison to pandemic and post pandemic trends when consumers had fewer places to go. This is playing a key factor in makeup being the fastest growing category.

Skincare is shifting and consumers are purchasing face serums, body sprays and facial cleansers as these categories are the top gainers in the prestige skincare market thus far in 2023.

Skincare usage remains flat compared to last year, yet product preferences are shifting. Consumers are seeking hybrid products that address skin concerns and provide makeup coverage. “In addition, more channel blending is taking place as 67% of consumers feel that skincare brands at drug stores or mass merchandisers are as good as higher priced department store brands, a sentiment which is up from last year.”

Fragrance is seeing growth in the prestige market. Gift sets, higher concentration fragrances and mini sizes are outperforming last year. Sales of fragrance gift sets have grown by 26%, eau de parfums and parfums are the only channels to experience a year-over-year increase in units sold and minis have accounted for 38% of total fragrances sold.

Hair product sales continue to boom at a faster pace in prestige, with online capturing about half of the sales. Furthermore, hair is the category with the highest average price increase in the prestige beauty market, growing at three-times the rate of the overall industry. Styling was the fastest-growing segment in prestige hair for the first half of the year.

At Premier, it’s our priority to keep a pulse on the industry, provide valuable insights to support our network, and both expand and nurture our relationships with top talent in the industry. Whether you’re seeking a new career opportunity or looking for top talent to support your company as it continues to grow and thrive, we’re here to help.