Every year CEW hosts their annual State of the Industry: Global Beauty Trend Report. And because having a pulse on the industry is extremely important to us and valuable to the work we do, we attend every year and like to share some of our top takeaways with our Premier network.

Attending this year’s virtual summit gave us access to fresh, exclusive data findings and sales trends from the industry’s top research powerhouses including NielsenIQ, Mintel, Circana, Google, Spate, CreatorIQ, and Iced Media, revealing the latest market data as well as beauty’s biggest moments. Below are our top findings giving insight and data to help you develop new strategy, to have a successful 2024.

The Future is Bright, Beauty will Thrive in 2024:

Beauty’s outlook remains strong for 2024, an ambitious prediction given the growth it’s experienced over the past two years. Circana reported that the outlook for U.S. beauty is bright, for both mass and prestige brands. With a double-digit dollar increase reported over the past year, prestige beauty is expected to outpace mass in 2024, according to Larissa Jensen, Circana’s SVP and Global Beauty Industry Advisor. “Consumers are not only spending more, they’re also buying more prestige beauty products during a time when they’re being more selective in their purchases overall,” said Jensen.

Below are key factors Jensen cites that will contribute to growth in 2024.

- Prestige beauty products have become the little luxuries consumers are using to treat themselves.

- Higher income consumers remain the largest consumer group purchasing prestige beauty products, representing 50% of the shopper base, and they continue to increase their spending

- Shorter replenishment cycles are keeping the beauty industry afloat. This is particularly true for the skin and hair care categories, both of which have higher daily usage frequencies.

- Brick and mortar stores are key. For prestige beauty, the store is not only a destination, but an experience, allowing consumers to touch and feel the products and interact with others.

Social Media is a Powerful Marketing Tool for 2024:

CreatorIQ Director of Content Marketing Alexander Rawitz reported that in 2024 the cosmetics and beauty e-commerce industry in the US is expected to generate roughly 88.5 billion in sales and is forcasted to reach over 94.5 billion by 2026. Consumer engagement on social media platforms like Instagram and TikTok are significant drivers of this anticipated growth in sales.

- We are in the era of social selling and last year alone, $70 billion was sold on the TikTok platform, and this number is expected to increase.

- Tools like Live Shopping on TikTok virality has long been a catalyst for beauty sales — now consumers can discover and purchase products in one place. Offers and promotions work in both regions and entice consumers to try new products.

- TikTok’s YoY shares of engagement are increasing at the fastest rate.

- TikTok users can now discover a beauty product in a video and purchase it instantly without having to switch apps or perform a time-consuming web search. This frictionless shopping experience is a game-changer, making impulse purchases a breeze.

- TikTok Shop provides valuable data to beauty brands about which products are performing well, allowing them to refine their marketing strategies and product offerings.

- Accessibility: Small and indie beauty brands can now reach a global audience directly through TikTok Shop, leveling the playing field and offering consumers a broader range of choices.

Minis are on the Rise:

Consumers want minis! Bite-sized products are becoming a main attraction for prestige brands and retailers are looking to widen their customer base. Premium beauty brands and retailers are increasing their assortment of mini beauty products and are placing them in more prominent areas of stores.

- Thanks to shrinkflation and online research, consumers are more price-conscious than ever when it comes to individual product prices.

- Mini beauty helps brands reach a more value-conscious customer

- Consumers are linking these “cute” mini products, and they are less expensive and feel as if they are not wasting product.

Wellness is Trending:

NIQ’s exploration revealed a dynamic crossover between beauty and wellness. The consumer view of beauty is expanding in the U.S Market. Now more than ever, consumers are seeking products that enhance not only external appearance but also internal well-being. As a result, the idea of beauty is expanding, and consumers are thinking beyond traditional beauty categories when looking to fulfill their self-care needs.

- 94% of consumers are prioritizing wellness

- Beauty and Personal care are up 11.7%, Wellness is up 11.8%, Beauty Body and Mind +11.7%

- The most notable growth segments in 2023 were in gut health, deodorant, home testing kits and mineral supplements. (Vital Proteins disrupted the supplements industry by popularizing the consumption of collagen, 2023 L52W Sales, $229M +22%)

- There’s a growing demand for supplement ingredients that offer both physical and mental health benefits.

The Power of Physical Retail:

Brick-and-mortar stores are important to the success of the beauty industry. In fact, the in-store experience is prestige beauty’s point of difference, compared to the mass market.

- For prestige beauty, the store is not only a destination, but an experience, allowing consumers to touch and feel the products and interact with others.

- This popularity won’t decline anytime soon, and as a result it is anticipated that the brick-and-mortar channels will outperform e-commerce in 2024.

- Given that the brick-and-mortar channel accounts for a larger portion of overall sales, in both the mass and prestige markets, physical retail will be a significant growth driver across most beauty categories this year.

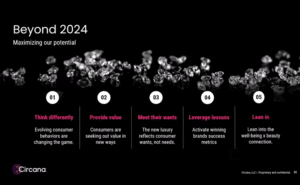

Beyond 2024 Opportunities to Maximize Potential:

Above were just some of our biggest takeaways, yet other noteworthy hot topics were:

- ‘Dermificaion’ in skincare

- The Growing Demand for Product Claims and Ingredients

- The Rise of Dupes

- Amazon Continues to Deliver Well Rounded growth

- Shoppers are Pivoting Between Premium and Value

Tips to maximize Potential for 2024:

Join our Network! Follow @Premier Executive Recruiting on LinkedIn to receive the latest beauty trends, statistics, interview tips, and career opportunities on a weekly basis as we keep you informed of the evolving beauty industry.